Introduction

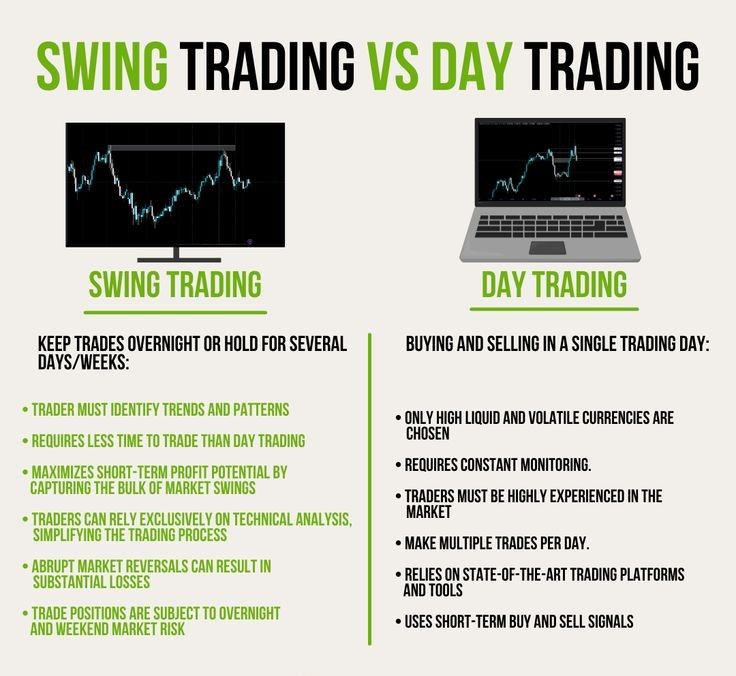

Swing trading is a popular trading style that seeks to capture short- to medium-term price movements over a period of several days to weeks. It’s ideal for traders who can’t monitor charts all day but still want to be active in the market. This strategy sits between day trading and long-term investing, offering a balanced approach that combines technical analysis with market timing.

This guide explains the fundamentals of swing trading, its advantages and disadvantages, and outlines proven strategies to help you succeed.

What is Swing Trading?

Swing trading involves taking advantage of “swings” in market prices—periods where price moves strongly in one direction before reversing. Traders enter during pullbacks or breakouts and aim to hold positions from a few days up to a few weeks.

Key Features:

- Trades last from several days to weeks.

- Relies heavily on technical analysis.

- Involves fewer trades than day trading.

- Suitable for part-time traders.

Pros of Swing Trading

- Less Time-Intensive: No need to watch charts constantly.

- Better Risk-to-Reward Ratios: Longer holding periods allow for wider profit targets.

- Flexible Strategy: Works in various markets—stocks, forex, crypto, and commodities.

- Lower Transaction Costs: Fewer trades mean lower fees compared to day trading.

- Reduced Emotional Pressure: Less noise compared to short-term charts.

Cons of Swing Trading

- Overnight Risk: Trades remain open during news events or market gaps.

- Requires Patience: Profits can take days or weeks to develop.

- False Signals: Longer timeframes can still produce misleading technical setups.

- Potential for Missed Opportunities: Holding trades may limit ability to capitalize on sudden market moves elsewhere.

Tools Needed for Swing Trading

- Charting Platform: With multi-timeframe analysis (daily, 4H, weekly).

- Technical Indicators: Moving averages, RSI, MACD, Bollinger Bands.

- Economic Calendar: For anticipating news events.

- Broker with low overnight fees: Especially important for forex and CFD swing traders.

Common Swing Trading Strategies

1. Moving Average Crossover

This strategy uses two moving averages (e.g., 50 EMA and 200 EMA). A buy signal is generated when the shorter MA crosses above the longer one, and a sell signal occurs when it crosses below.

- Entry: On crossover confirmation.

- Exit: At opposite crossover or when price hits resistance/support.

2. Support and Resistance Reversals

Traders identify key horizontal levels where price frequently reverses. A bounce from support or rejection from resistance signals potential trade setups.

- Entry: When price reacts strongly to a key level.

- Confirmation: With candlestick patterns (pin bars, engulfing).

- Stop-loss: Below/above the level.

- Target: Next resistance/support zone.

3. Breakout Strategy

Price builds up within a range or triangle pattern. A breakout above resistance or below support signals entry.

- Confirmation: Volume surge or retest of the broken level.

- Risk: Watch for false breakouts; wait for candle close.

4. Trend Continuation with Pullbacks

In a strong trend, wait for a pullback to a moving average (e.g., 20 EMA) or Fibonacci level, then enter in the direction of the trend.

- Indicators: RSI (50 zone), Fibonacci retracement (38.2%, 50%, 61.8%).

- Best markets: Trending pairs or stocks with strong momentum.

Risk Management in Swing Trading

Even though trades are less frequent, risk management remains critical.

- Risk per trade: 1–2% of account balance.

- Stop-loss: Use chart levels, not arbitrary distances.

- Position sizing: Based on risk tolerance and volatility.

- Diversification: Avoid overexposure to a single asset class.

Best Timeframes for Swing Trading

- Daily chart: Most reliable for spotting trends and major levels.

- 4-hour chart: Good for timing entries and exits.

- Weekly chart: For identifying macro trend direction.

Avoid using very short timeframes (like 5-min or 15-min) in swing trading—they introduce noise and require more monitoring.

Psychological Aspects of Swing Trading

Swing trading requires a calm mindset and discipline to hold trades without overreacting to every minor fluctuation. Key traits of successful swing traders include:

- Patience: Letting trades play out without interference.

- Confidence: Trusting your analysis.

- Discipline: Sticking to your plan, especially when price moves slowly.

Example of a Simple Swing Trade Setup

- Asset: GBP/USD

- Chart: Daily

- Setup: Price pulls back to 50 EMA in an uptrend

- Entry: Bullish engulfing candle confirmation

- Stop-loss: Below recent swing low

- Take-profit: Previous swing high

- Risk/Reward: At least 1:2

Tips for Beginners in Swing Trading

- Start with a demo account to test your strategies.

- Keep a trading journal to analyze wins and losses.

- Stick to 1 or 2 strategies until you master them.

- Avoid overtrading—quality matters more than quantity.

- Focus on liquid markets with reliable price movements.

Conclusion

Swing trading offers a balanced path between the fast pace of day trading and the long commitment of investing. It’s ideal for part-time traders who want to trade with structure and discipline. By focusing on well-defined strategies, maintaining strong risk management, and staying emotionally grounded, beginners can gradually build a profitable swing trading approach.