Introduction

Support and resistance levels are foundational concepts in technical analysis. They represent psychological price barriers where supply and demand dynamics shift, often resulting in a change in price direction. Understanding how to identify these zones can help traders make better decisions, time their entries and exits more effectively, and avoid common traps.

In this guide, we’ll explore what support and resistance are, how to find them, and how to use them in real trading situations.

What is Support?

Support is a price level where a downtrend tends to pause or reverse due to a concentration of demand. As the price falls and reaches support, more buyers are willing to enter the market, preventing the price from falling further.

Key Features:

- Formed when price hits a level multiple times without breaking it

- Indicates strong buying interest

- Can become resistance if broken

What is Resistance?

Resistance is a price level where an uptrend tends to stall or reverse due to selling pressure. As the price rises and reaches resistance, more sellers enter the market, causing the price to retreat.

Key Features:

- Occurs when price fails to move above a certain level

- Reflects strong selling pressure

- Can become support if broken

Why Support and Resistance Matter

Understanding support and resistance can help you:

- Identify entry/exit points

- Set stop-loss and take-profit levels

- Avoid buying at market tops or selling at bottoms

- Gauge trend strength and reversals

Types of Support and Resistance Levels

1. Horizontal Levels

These are price levels where the market has reversed or consolidated previously.

- Easy to spot on charts

- Most commonly used in trading

2. Trendlines

Support and resistance can also appear in the form of diagonal lines, connecting higher lows (support) or lower highs (resistance).

- Show dynamic levels as price moves over time

- Can break and become reversal signals

3. Moving Averages

Indicators like the 50-day or 200-day moving average often act as support/resistance, especially in trending markets.

- Adaptive to market movements

- Frequently used in conjunction with price action

4. Fibonacci Retracement Levels

These are mathematical retracement zones derived from the Fibonacci sequence, commonly used to predict pullbacks.

- Levels like 38.2%, 50%, and 61.8% are key

- Combine well with other support/resistance tools

5. Psychological Levels

Round numbers (e.g., 1.2000 in forex or 100 in stocks) often act as psychological barriers where traders place large orders.

How to Identify Strong Support and Resistance Levels

1. Look for Multiple Touches

The more times a level has been tested and held, the stronger it becomes.

2. Observe Volume

High volume near a level confirms its importance—buyers or sellers are aggressively defending it.

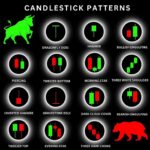

3. Analyze Candle Behavior

Wicks rejecting a price level often signal strong support or resistance.

4. Use Multiple Timeframes

Levels on higher timeframes (daily, weekly) are more reliable than those on smaller charts.

How to Trade Using Support and Resistance

1. Bounce Trading

Buy at support and sell at resistance when price bounces off these levels.

- Entry: Confirmation of bounce (candle pattern or volume)

- Stop-loss: Just below support or above resistance

- Take-profit: Near the opposite level

2. Breakout Trading

Trade when price breaks through a level with momentum.

- Entry: After breakout with high volume

- Stop-loss: Below the breakout point

- Take-profit: Based on recent price range or risk-reward ratio

3. Retest Strategy

Wait for price to break a level and return to retest it before entering.

- Entry: On retest confirmation (e.g., bullish candle after pullback)

- More reliable than immediate breakout entry

Common Mistakes to Avoid

- Trading before confirmation: Wait for the candle to close above/below the level.

- Ignoring market context: A level that worked yesterday may not work today.

- Forcing levels: Not every high/low is valid support or resistance.

- Not adjusting to market volatility: Levels can be zones, not precise lines.

Support and Resistance Zones vs. Exact Levels

It’s important to understand that support and resistance often act as zones rather than fixed lines. Price may penetrate a level slightly before reversing. Using buffer zones helps avoid false signals and early exits.

Combining with Other Tools

Support and resistance become more powerful when combined with:

- RSI or MACD: To confirm overbought/oversold conditions

- Trendlines or Channels: To assess the broader direction

- Chart Patterns: Head and shoulders, double tops/bottoms

Conclusion

Support and resistance levels are among the most powerful tools in a trader’s toolkit. By learning how to identify them and interpret their significance, you can develop a more structured and disciplined approach to trading. Whether you’re trading trends, breakouts, or reversals, these key zones provide the foundation for consistent market analysis.

Remember: Always wait for confirmation, combine with other tools, and practice identifying levels across different timeframes. With time and experience, support and resistance will become second nature in your trading journey.