Introduction

Trading without a plan is like sailing without a compass. Many traders enter the market with excitement but without direction, often leading to inconsistent results and emotional decisions. A trading plan acts as a structured guide, providing clear rules for when to enter, manage, and exit trades.

In this article, we’ll explore what a trading plan is, why it’s crucial, what it should include, and how to build one that aligns with your trading goals and personality.

What is a Trading Plan?

A trading plan is a comprehensive document that outlines a trader’s strategies, risk management rules, and personal goals. It removes guesswork and emotion from the decision-making process by defining clear actions for every trading scenario.

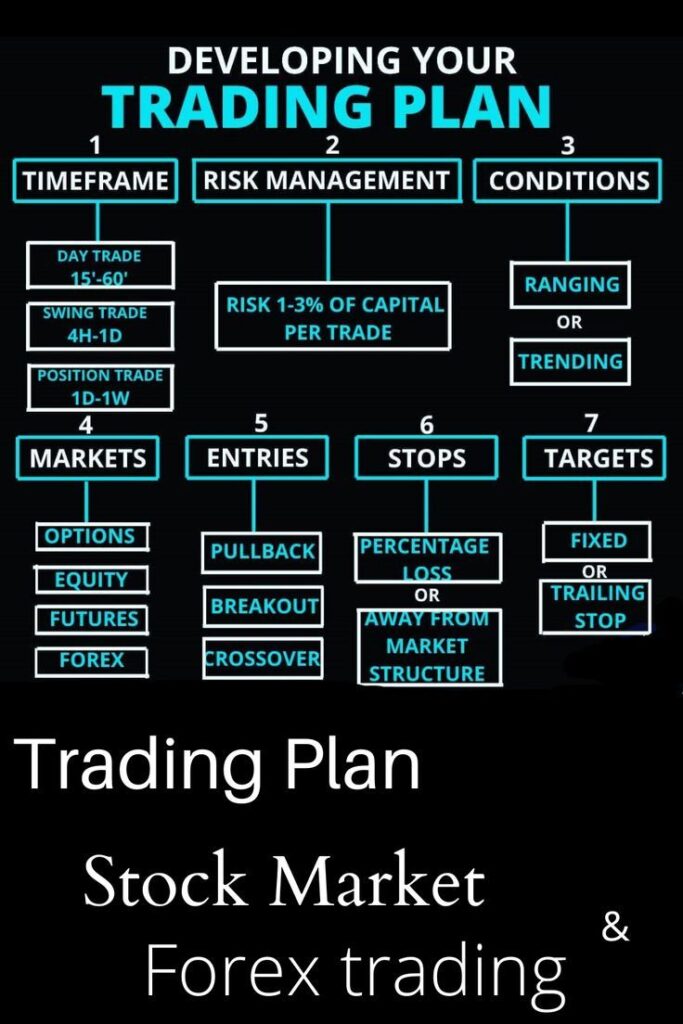

The plan includes:

- Entry and exit criteria

- Risk and money management rules

- Timeframes and instruments to trade

- Psychological preparation and discipline techniques

A trading plan is personalized—what works for one trader may not suit another.

Why Every Trader Needs a Trading Plan

- Consistency

A plan helps you make decisions based on logic and predefined rules, not emotion or impulse. - Accountability

It allows you to track performance and understand whether your losses came from bad execution or bad strategy. - Improved Risk Management

Plans define how much to risk per trade, preventing overexposure. - Confidence

Knowing your rules in advance helps reduce anxiety during market fluctuations. - Adaptability

A plan can evolve with your experience, allowing you to refine your approach over time.

Key Components of a Trading Plan

1. Trading Goals

Define both short-term and long-term goals.

Examples:

- Grow account by 5% per month

- Achieve consistency over 6 months before increasing risk

- Limit drawdown to no more than 10%

Goals should be realistic, measurable, and time-bound.

2. Market Selection

Specify which assets or markets you will trade, such as:

- Forex (EUR/USD, GBP/USD)

- Stocks (Apple, Tesla)

- Commodities (Gold, Oil)

- Crypto (Bitcoin, Ethereum)

Stick to a few instruments you can understand and monitor closely.

3. Trading Timeframe

Choose the timeframe(s) that suit your lifestyle and trading style:

- Scalping: 1-min to 5-min

- Day Trading: 15-min to 1-hour

- Swing Trading: 4-hour to daily

- Position Trading: Daily to weekly

Your plan should match your availability and psychological comfort.

4. Strategy and Entry Rules

Define exactly how you’ll enter a trade:

- Technical indicators (e.g., RSI, MACD, moving averages)

- Chart patterns (e.g., head and shoulders, trendlines)

- Candlestick patterns (e.g., pin bars, engulfing candles)

- Fundamental signals (e.g., news releases, earnings reports)

Include screenshots or diagrams if needed.

5. Exit Rules

A trade is only complete when it’s closed. Your plan should state:

- Where to place your stop-loss

- How to set your take-profit

- Rules for early exit (e.g., pattern break, news release)

Avoid emotional exits—stick to your predefined rules.

6. Risk Management

Decide in advance:

- How much to risk per trade (e.g., 1-2% of account)

- Maximum daily and weekly loss limits

- Maximum number of trades per day

Risk management protects your capital more than any strategy.

7. Position Sizing Formula

Your plan should include how to calculate trade size.

Example formula:

Position size = Risk amount / (Stop loss in pips × pip value)

This ensures that risk remains consistent regardless of trade size.

8. Trading Journal

Track every trade including:

- Entry and exit points

- Reasons for the trade

- Mistakes or emotional decisions

- Result (profit/loss)

- Screenshot of the chart

A journal reveals patterns in your behavior and areas to improve.

9. Psychological Preparation

Include ways to maintain discipline:

- Pre-trading routine (review charts, read plan)

- Avoid trading when emotional, tired, or distracted

- Use affirmations or breathing techniques if needed

Your mindset is just as important as your strategy.

How to Create Your Own Trading Plan

- Write It Down: Use a digital document or printable template. Don’t keep it in your head.

- Start Simple: Avoid overcomplicating. Your plan should be clear and executable.

- Test Your Plan: Use demo or backtesting to ensure the strategy is valid.

- Follow It Strictly: Treat your plan as law—only change it based on tested improvements, not feelings.

- Review Weekly or Monthly: Evaluate performance and refine the plan as needed.

Common Mistakes to Avoid

- Trading without a plan

- Changing rules in the middle of trades

- Ignoring stop-loss or risk rules

- Trading too many assets

- Letting emotions override your system

- Failing to review and improve

Conclusion

A trading plan is not optional—it’s essential for any trader aiming for long-term success. It creates structure, promotes discipline, and enables consistent decision-making.

Remember, trading is a business, not a game. Professionals don’t rely on luck; they rely on systems. Building and following a solid trading plan is the first step toward becoming a consistent and profitable trader.