Introduction

Position trading is a long-term trading strategy where traders hold positions for weeks, months, or even years. Unlike day traders or scalpers who seek quick profits from small price movements, position traders focus on capturing large market trends. This strategy involves less frequent trading, a strong emphasis on fundamental analysis, and the patience to wait for high-probability setups to develop over time.

In this comprehensive guide, we will explore how position trading works, its advantages and challenges, key tools and indicators, and the mindset required to succeed.

What is Position Trading?

Position trading is a strategy that involves buying and holding assets for an extended period based on a long-term outlook. It is commonly used in forex, stocks, commodities, and cryptocurrencies. The goal is to profit from significant price movements driven by macroeconomic trends, policy shifts, or structural changes in the market.

Key Features:

- Trade duration: Weeks to years.

- Emphasis on big-picture trends.

- Low trading frequency.

- Focus on fundamental and technical analysis.

- Larger stop-losses and wider profit targets.

Who Should Consider Position Trading?

Position trading is well-suited for:

- Part-time traders or those with limited screen time.

- Long-term investors who value macro analysis.

- Traders with patience and emotional discipline.

- Those who prefer less frequent but high-quality trades.

It’s not ideal for:

- Traders seeking fast results or daily action.

- Those uncomfortable with long holding periods or overnight risks.

Benefits of Position Trading

- Lower Transaction Costs: Fewer trades mean fewer commissions and slippage.

- Less Stressful: No need to monitor charts constantly.

- Time Efficiency: Perfect for those with other commitments.

- Leverages Market Trends: Enables profit from long-term economic cycles.

- Less Affected by Noise: Reduces impact of short-term volatility.

Drawbacks of Position Trading

- Requires Patience: Profits take time to materialize.

- Larger Capital Requirement: Long holds may tie up capital.

- Exposure to Market Gaps: Overnight or weekend news can cause gaps.

- Higher Risk Per Trade: Wider stop-losses require careful risk management.

- Emotional Pressure: Watching unrealized profits fluctuate can be stressful.

Best Markets for Position Trading

Position trading is ideal for markets with well-defined long-term trends:

- Forex: Major pairs like EUR/USD, USD/JPY.

- Stocks: Growth and value stocks with strong fundamentals.

- Indices: S&P 500, NASDAQ, Dow Jones.

- Commodities: Gold, oil, agricultural assets.

- Crypto (with caution): Long-term investing in BTC, ETH.

Timeframes Used

While trades are held for weeks/months, position traders use higher timeframes to analyze trends:

- Weekly (W1) for trend identification.

- Daily (D1) for entry and exit planning.

- Monthly (MN) for long-term outlook and macro perspective.

Position Trading Strategies

1. Fundamental-Driven Trend Following

This strategy focuses on economic indicators, central bank policy, GDP, employment data, and geopolitical events to identify long-term trends.

- Example: Buying a currency pair where the interest rate differential favors one currency over the other.

- Tools: Economic calendar, central bank statements, inflation and interest rate trends.

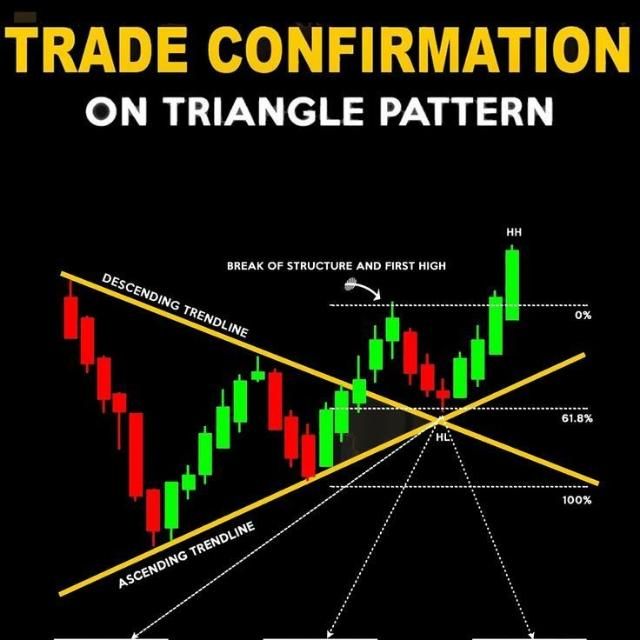

2. Breakout from Long-Term Ranges

Traders look for breakouts from key support/resistance levels or consolidation zones.

- Entry: After confirmation of a weekly or monthly breakout.

- Stop-loss: Below the breakout level.

- Exit: At long-term resistance or trend exhaustion.

3. Trendline and Channel Trading

Using trendlines or price channels on higher timeframes, traders buy at channel support and sell at channel resistance.

- Confirmation: Candlestick patterns or momentum divergence.

- Timeframe: Weekly or daily charts.

Key Indicators for Position Trading

- 200-Day Moving Average: Measures long-term trend direction.

- MACD (Moving Average Convergence Divergence): Helps identify momentum and trend changes.

- Fibonacci Retracement: Identifies correction levels for entry.

- Relative Strength Index (RSI): Detects overbought/oversold conditions on longer timeframes.

- Volume Indicators: Confirms breakout strength.

Risk Management for Position Trading

Position trading involves larger stop-losses, so capital preservation is essential:

- Risk per trade: 1–2% of account balance.

- Use trailing stop-losses to lock in gains as the trend progresses.

- Diversify: Avoid overexposure to one asset class or market.

- Stay informed: Macro news can shift long-term trends suddenly.

Tools and Platforms

- Economic Calendars: Track central bank decisions, inflation, GDP reports.

- Charting Software: TradingView, MetaTrader 5, cTrader.

- News Aggregators: Bloomberg, Reuters, ForexFactory.

Example of a Position Trade (Forex)

- Asset: GBP/USD

- Setup: Weekly breakout above 1.3000 resistance

- Entry: At 1.3050 after breakout confirmation

- Stop-loss: 1.2700 (350 pips)

- Target: 1.4000 (950 pips)

- Holding Time: 4–8 weeks

- Risk/Reward: 1:2.7

Position Trading vs. Investing

While both involve long-term positions, there are differences:

| Feature | Position Trading | Investing |

|---|---|---|

| Basis for Decision | Technical + Fundamental | Mostly Fundamental |

| Holding Time | Weeks to months | Months to years |

| Use of Leverage | Often Yes | Rarely |

| Trade Frequency | Low | Very Low |

| Exit Criteria | Based on technical levels | Based on valuation or news |

Psychological Discipline in Position Trading

Holding trades over long periods tests patience and emotional control. Traders must:

- Stick to the original plan, even during drawdowns.

- Avoid checking the charts too frequently.

- Manage emotional swings during market corrections.

- Stay confident in their analysis.

Conclusion

Position trading is a powerful strategy for traders who value long-term trends over short-term fluctuations. It rewards patience, preparation, and a deep understanding of macroeconomic dynamics. While the waiting period can be challenging, the potential for substantial returns with fewer trades makes it an attractive option for disciplined traders.

With the right tools, risk management, and mindset, position trading can offer a stress-reduced yet profitable path in the financial markets.