Introduction

Scalping is a high-speed trading strategy that focuses on making dozens—or even hundreds—of small trades within a single day. Unlike swing trading, which seeks to capture multi-day price moves, scalping targets tiny price fluctuations in seconds or minutes. The goal is to generate consistent profits through rapid execution, precision, and volume.

This guide explains how scalping works, who it suits best, which tools and indicators to use, and how to manage risks when operating at this fast pace.

What is Scalping in Trading?

Scalping is a short-term trading method where traders aim to profit from small price movements. Most scalpers hold trades for only a few seconds to a few minutes. The idea is to capitalize on minor inefficiencies in the market, such as bid-ask spreads or short-lived momentum.

Key Characteristics:

- Extremely short trade durations (seconds to minutes).

- High trade frequency per session.

- Relies on speed, tight spreads, and low slippage.

- Heavy focus on technical analysis and order flow.

Who is Scalping For?

Scalping isn’t for everyone. It requires specific qualities:

- Fast decision-making skills.

- Strong focus and attention to detail.

- Ability to handle pressure and fast-changing market conditions.

- Access to high-speed internet and a reliable trading platform.

It’s ideal for traders who:

- Enjoy being active in the market.

- Can dedicate full time to trading sessions.

- Prefer immediate results over long-term trades.

Pros of Scalping

- Fast Results: You know the outcome of your trade in minutes.

- High Frequency: More trading opportunities per day.

- Minimized Overnight Risk: No positions are held after market close.

- Adaptability: Works in both trending and ranging markets.

Cons of Scalping

- Requires Intense Focus: Missing a few seconds can cost a trade.

- High Transaction Costs: Frequent trades mean higher broker fees/spreads.

- Emotionally Draining: Constant action can lead to fatigue and errors.

- Slippage Risk: Especially during news events or volatile periods.

Best Markets for Scalping

Scalping works best in highly liquid and volatile markets such as:

- Forex pairs: EUR/USD, GBP/USD, USD/JPY.

- Indices: S&P 500, NASDAQ.

- Cryptocurrencies: BTC/USD, ETH/USD (on low spread platforms).

- Commodities: Gold (XAU/USD), Oil (WTI).

Best Timeframes for Scalping

Scalpers typically use:

- 1-minute (M1) and 5-minute (M5) charts.

- Tick charts or range bars for high-frequency setups.

- Lower timeframes provide more signals but also more noise, so precision is key.

Popular Scalping Strategies

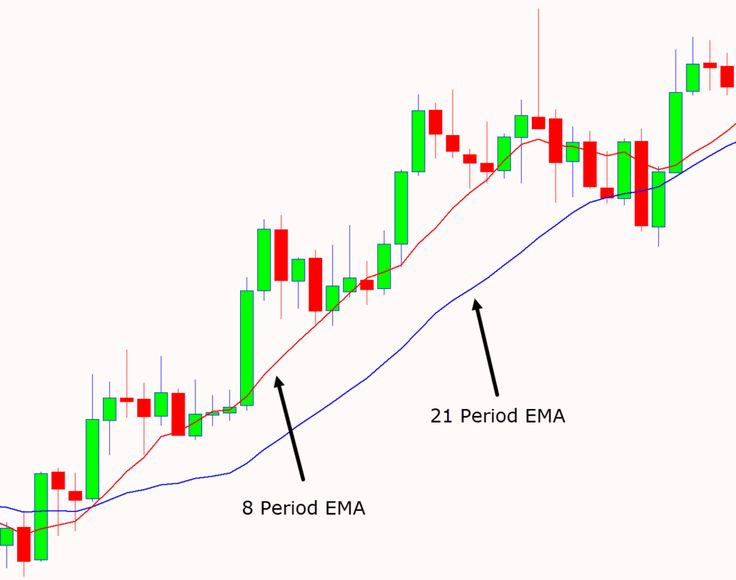

1. Moving Average Bounce

This strategy uses a short-term moving average (e.g., 9 or 20 EMA). When price pulls back to the EMA in a strong trend, it offers a quick-entry opportunity.

- Entry: At bounce confirmation with a candlestick pattern.

- Exit: 5-10 pips or near resistance/support.

- Stop-loss: Tight, just behind the moving average.

2. Breakout Scalping

Wait for price to break out of a tight consolidation range. Scalpers enter the market as soon as price breaks support or resistance.

- Confirmation: Volume spike or breakout candle close.

- Risk: High chance of false breakouts.

- Tip: Use VWAP or volume-based filters.

3. Order Book and DOM Analysis (Advanced)

Using Level 2 data or depth-of-market (DOM), scalpers identify where large buy/sell orders exist and trade short bursts of momentum.

- Requires: Advanced platform, ECN broker, and fast execution.

- Mostly used: In futures and stock markets.

Best Technical Indicators for Scalping

- Moving Averages (EMA/SMA): For trend and dynamic support/resistance.

- RSI (Relative Strength Index): For short-term overbought/oversold signals.

- MACD (5,13,1): Modified for fast setups.

- Bollinger Bands: For volatility squeezes and breakouts.

- Volume Indicators: Help confirm breakout strength.

Risk Management in Scalping

Because scalping involves many trades, strict risk control is critical:

- Risk per trade: 0.5% or less of account balance.

- Use tight stop-losses: 5–10 pips max in forex.

- Daily loss limit: Stop trading after a fixed dollar or percentage loss.

- Avoid revenge trading: It’s easy to spiral after back-to-back losses.

Tips for Successful Scalping

- Use a low-spread broker with fast execution.

- Practice on a demo account before going live.

- Focus on one or two pairs/markets.

- Trade during high liquidity sessions (e.g., London and New York overlap).

- Avoid scalping during major news releases unless you’re highly experienced.

Technology Requirements for Scalping

- Fast computer and low-latency internet.

- Direct Market Access (DMA) or ECN brokers.

- Platforms that support one-click trading (like MetaTrader, NinjaTrader, cTrader).

Psychological Discipline

- Scalping tests your emotional resilience.

- You must act without hesitation but avoid impulsiveness.

- Take breaks to prevent burnout.

- Stick to a clear plan and predefined rules.

Example of a Simple Forex Scalping Trade

- Asset: EUR/USD

- Chart: 1-minute

- Strategy: EMA bounce

- Entry: Price bounces off 20 EMA with bullish pin bar

- Exit: +8 pips

- Stop-loss: -5 pips

- Risk/Reward: 1:1.6

Conclusion

Scalping offers a dynamic and fast-paced trading style that appeals to active traders seeking immediate results. While the potential for quick profits is real, so too is the risk of rapid losses. With the right tools, disciplined execution, and a solid understanding of the market, scalping can become a powerful part of your trading toolkit.

Whether you trade forex, stocks, or crypto, mastering a scalping strategy requires preparation, patience, and precision. Start small, stay consistent, and improve with experience.